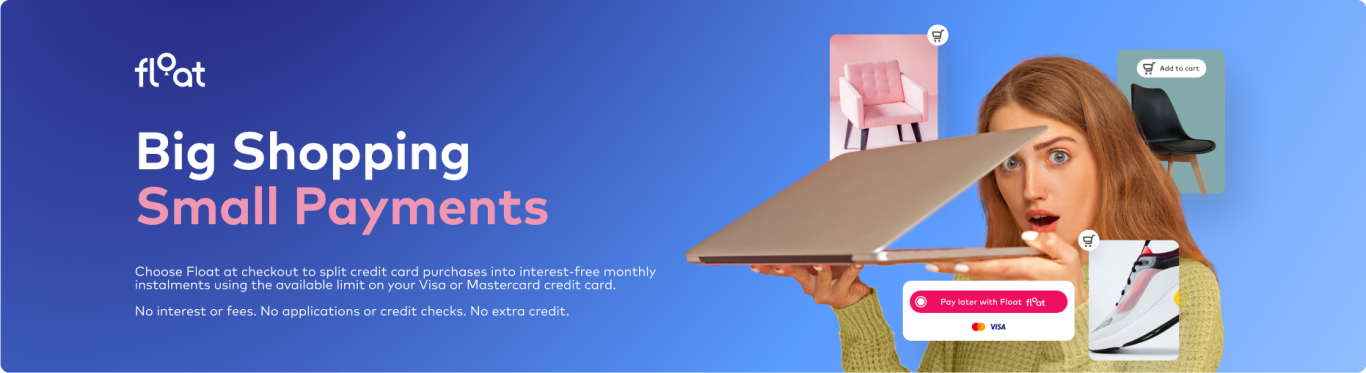

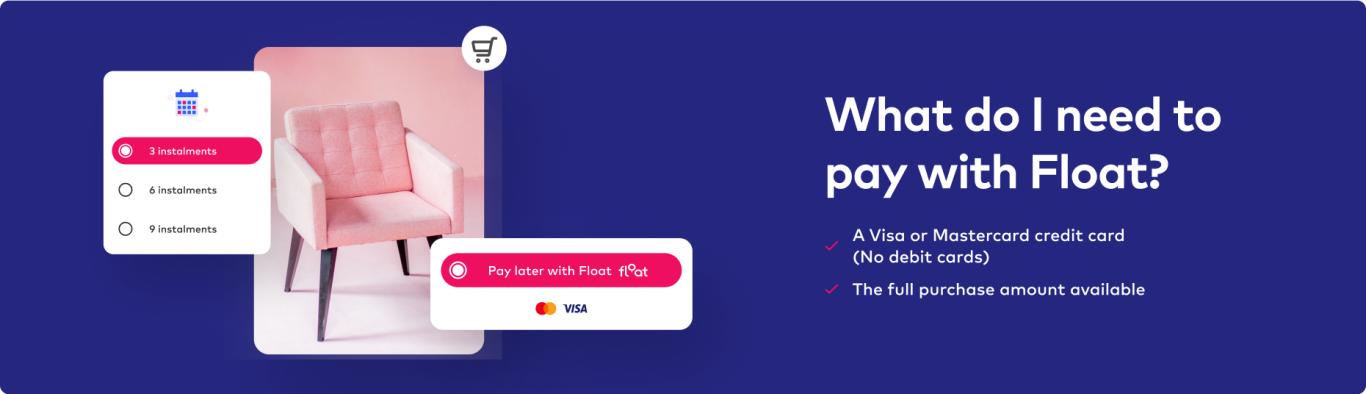

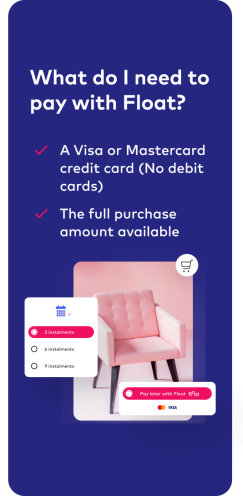

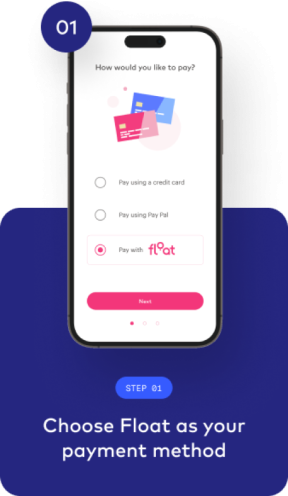

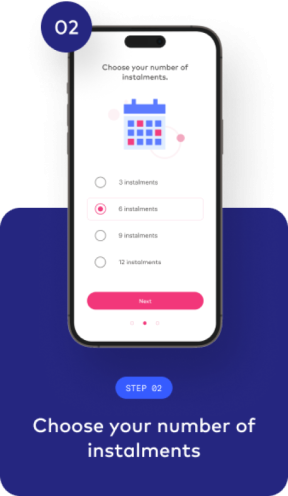

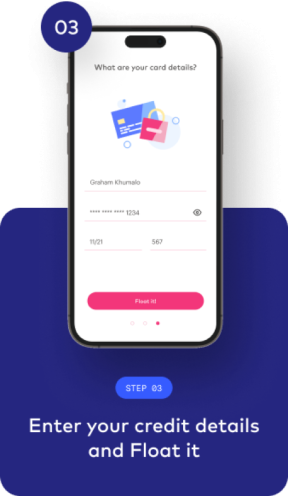

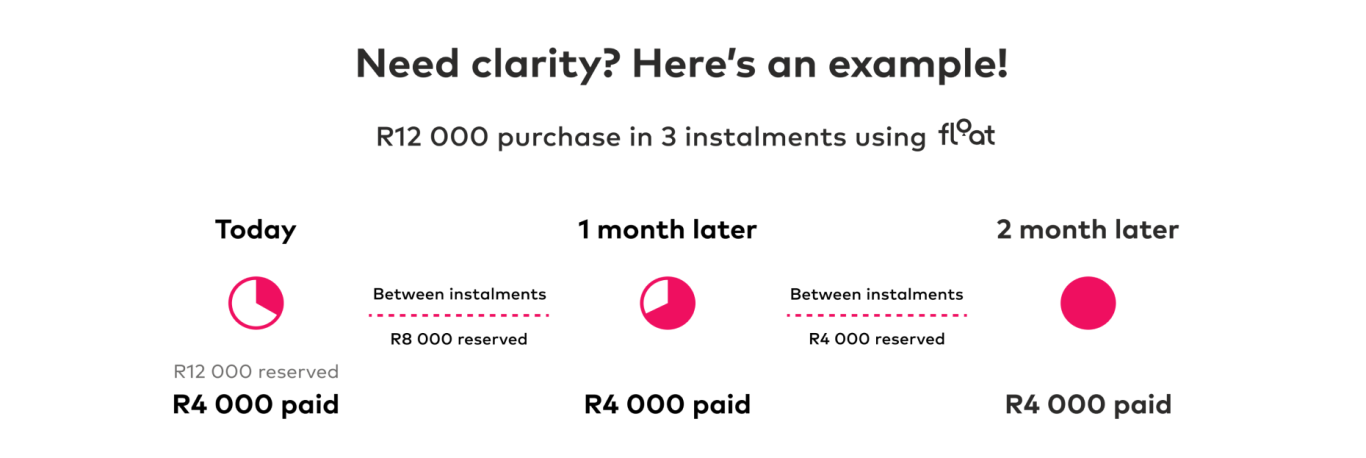

Float is a buy now pay later platform that lets you split purchases over up to 24 interest-free, fee-free monthly instalments using the available limit on your existing Visa or Mastercard credit card, without any application or credit check.

Think of it like an interest-free ‘budget facility’ – you get to enjoy your purchases today, pay for them over time and you don’t take out any extra credit to do so, either.